Disability Insurance

Disability insurance can help protect you and your family from an unexpected illness or accident that leaves you unable to work and earn an income. Generally, disability insurance replaces between 60% and 85% of your regular income, up to a maximum amount, for a specified time if you: temporarily can't work are permanently disabled due to an injury or illness Permanent refers to the nature of the disability. It does not mean that you'll get benefits for the rest of your life. Many employers offer disability insurance. However, you can get your own disability insurance plan through a life and health insurance agent. If you're self-employed, you can also get disability insurance that will cover many of your business expenses if you're unable to work.

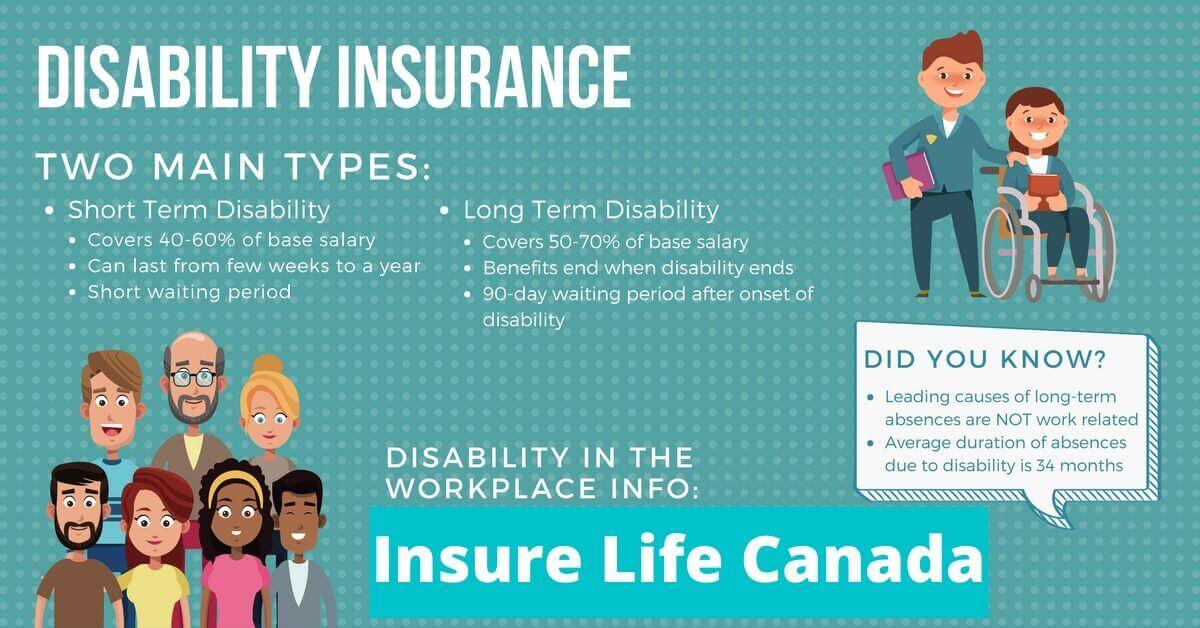

Short-term disability insurance

Long-term disability insurance

Help Protect Your Lifestyle and Recover from a Serious Illness. Let us guide you with simple and easy process and help you find best prices.

We’ll find you which company will give you the least expensive insurance quote possible. Since we have best insurance companies to choose from, we are usually successful at doing that.

Get a free consultation Apply NowHow Disability Insurance Works?

Disability insurance is designed to replace a portion of your income if you become disabled and are unable to earn an income. A disability can result from a number of causes, including an injury, a serious illness or a mental health issue. And the duration of a disability can be either short- or long-term. There are different kinds of disability insurance coverage, including individual insurance plans and group insurance plans, as well as government plans such as workers’ compensation and benefits provided under the Canada Pension Plan.

Why should you consider Disability Insurance?

Getting disability insurance can bring you great peace of mind. Knowing you’ll have a financial safety net should you fall seriously disable can allow for economic flexibility in your future plans and safeguard you and your family against the unexpected.

- Flexible Options: Our disability insurance plans offer a range of options to choose from, including the Family Compassionate Care Rider, a first-of-its-kind.

- Fills Coverage Gap: Canada Pension Plan (CPP) and Quebec Pension Plan (QPP) disability benefits are limited and may be more restrictive.

- Helps You Return to Work: Many of our plans provide return to work benefits such as rehabilitation, job retraining and other services to help you get back to work.

MENDRE Insurance Group is here to guide you with simple process

Depending on your situation you may need only critical illness or disability insurance but there are many times when you need both to fully protect yourself. Critical illness and disability insurance work together to help reduce the impact of disability or serious illness. Let MENDRE Insurance Group help you to understand the complete process in easy way.

Contact UsGet QuoteWhat to ask when buying disability insurance?

When buying disability insurance make sure you understand the following. Ask your benefits administrator or insurance agent about anything you don't understand.

General terms and conditions

How the plan defines disabilityAre there any exclusions

Are there any pre-existing condition clauses in the plan that you should be aware of

Premiums

How much the policy will costDo you still need to make premium payments while living with a disability

Benefits

The amount of money you'll get each monthAre the benefits taxable

Will benefits be adjusted for inflation

How long you need to wait before starting to receive benefits

Does the plan include partial disability benefits

Can you increase your coverage without a medical exam

Individual plans

Is the policy “guaranteed renewable” meaning you have the right to renew the policy, usually without additional evidenceGroup plans

Is your group plan provided by an insurance company or is it self-funded by the employerWill you still get benefits from a self-funded plan if the employer goes bankrupt or faces financial difficulty. If you leave your job, are there provisions to continue your existing coverage until you get new coverage. Contact Us Get Quote